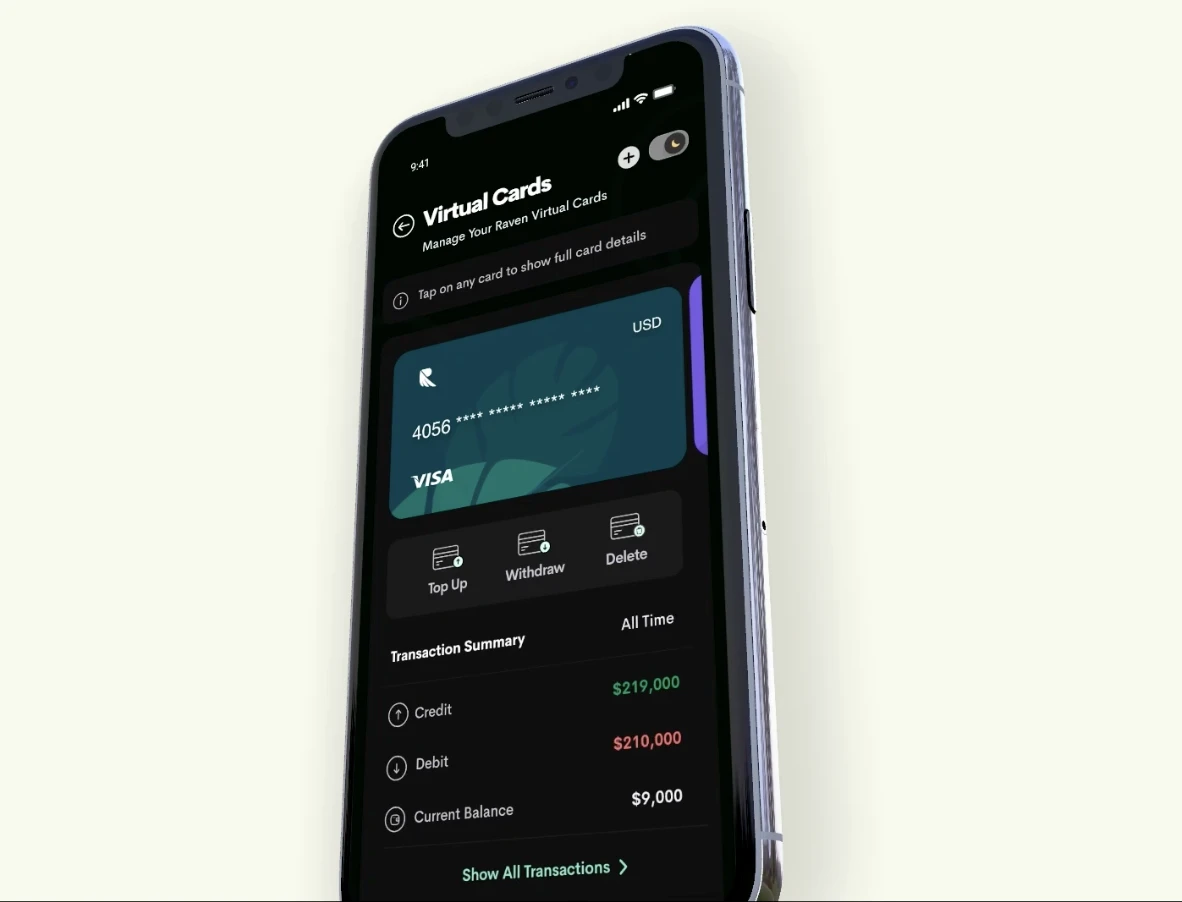

In the swift-moving world we live in now, payments are now done in different ways than the traditional method we are used to. Virtual cards, like other tools enabling transactions, are some of the most effective forms of payment tools. They are as secure as they are for other forms of payment transactions. They are also easy to use. Virtual cards, unlike plastic cards, exist on the internet and are able to allow payments safely and flexibly without the user risking their banking details.

Since transactions are done via the internet, the chances of data breach and fraud are heightened. This is exactly where the virtual card shines. Every virtual card is created with distinct details. This ensures that the users of the cards are able to safely transact without their primary info. The card can be disabled immediately, and this stops potential loss and other abuses.

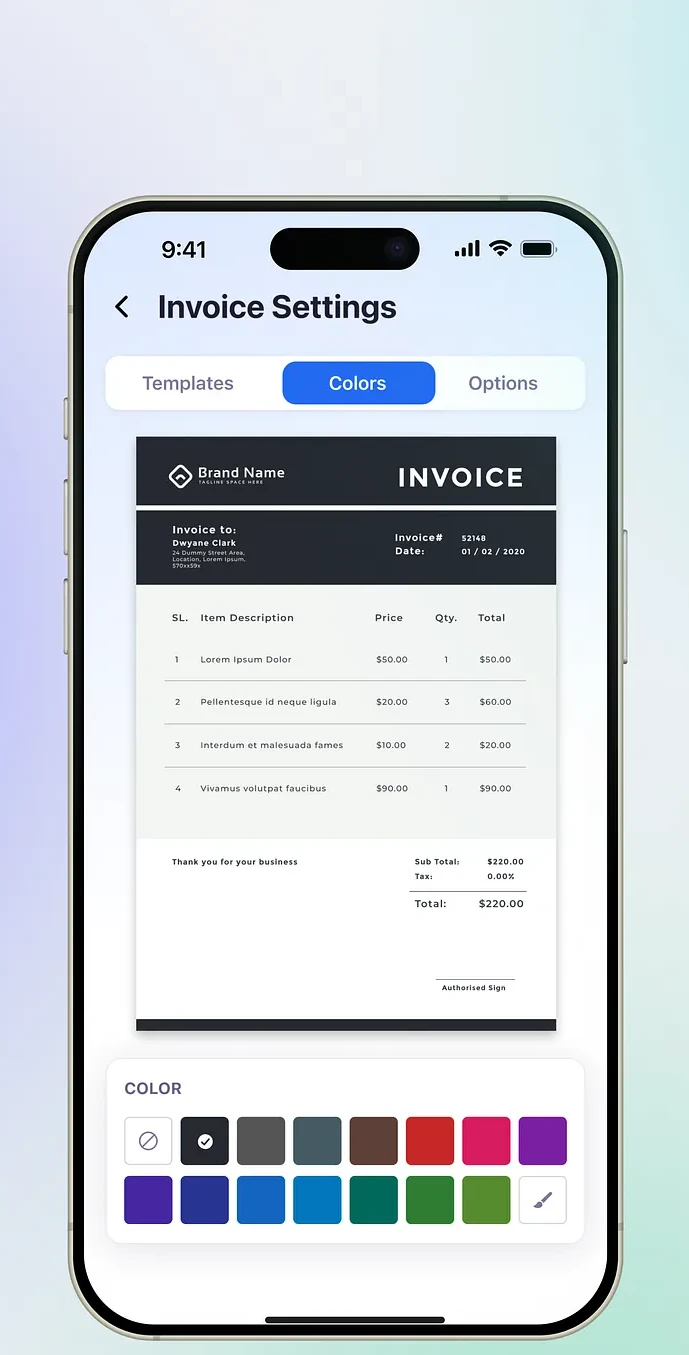

Virtual cards offer users time-saving digital payment methods and administrative and real-time expenditure control. For companies, they add streamlined administrative functions to the payment methods offered. Individual users of virtual cards are also able to add administrative value by enabling real-time expenditure controls. This also provides additional security users need on their payment methods.

Virtual cards would also help in improving the productivity of your customers. Customers could create a budget for their online and mobile payments using their virtual cards. They could instantly set their spending limits, review their budgets, and make purchase decisions by evaluating their expense needs. Physical cards would make these steps more tedious and would take far more time. They also improve tracking the pacing of time and money while making the decisions to spend.

Streamlined and uncomplicated mechanisms can help customers feel more in control of their spending. They can help set their budgets without worrying whether funds are available. Customers also feel more at ease knowing their accounts are protected against online transaction risks. The nature of payments and finances is changing. Managing money virtually is no longer a choice. Virtual cards provide a step forward in ease of transaction and help create a more transparent system of virtual payments. Plus, it adds another layer of protection for transparent virtual finance systems.